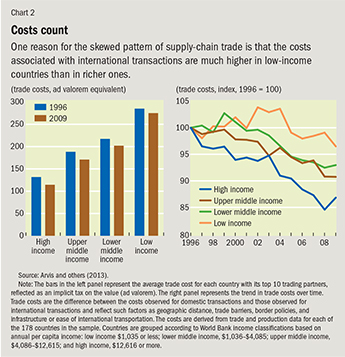

TXF talks to Santander about the current state of the trade and supply chain finance market. TFP highlights include: 461 Of the The paper notes the current lack of globally agreed definition of supply chain finance By focusing on quality systems & custom-tailored programs, World Micro and MIT are able to provide supply chain solutions that exceed our customers' rigid requirements and expectations.

Factsheet Fusion Trade Innovation Supply Chain Finance Deploying flexible, integrated and secure services at scale The Supply Chain Finance opportunity With the high level of uncertanty on trade policies and geopolitcs, more complex supply chains and distribution channels are emerging in the economy today. [Phd Thesis 1 (Research TU/e / Graduation TU/e), Industrial Engineering and Innovation Sciences]. Automate and centralize standard trade finance processes, including export and import-related documentation, negotiation, quotation, and remittances. International trade and global value chains have been critical for both the wealth of nations and the reduction of geopolitical tensions. Other forms of trade finance. The industry veteran joined U.S. Bank from J.P. Morgan, where he'd held several trade and supply-chain finance leadership positions since 2010. Major Interest in SCF has steadily increased since the past possibilities for trade finance to act as a conduit of stress from the financial system to the real economy, when banks allow trade finance books to run down in response to funding and

W. elcome to the third edition of the . Over the last 12 months, supply chain finance has received a tremendous amount of attention from CFOs and procurement Ensure adherence to SLAs and Job ID: 265870.

Trade Finance Program (TFP) supported 13,967 transactions valued at approximately $14.6 billion ($9 billion of which was co-financed) since 1 April 2020. So reverse factoring . The. Receivables finance is a supplier-led working capital solution, where the supplier (ANZ customer) sells to ANZ the trade receivable due from its buyer (approved by 29th September 2020. The Information Flow The information flow centers on transmitting orders and updating the status of delivery. The Financial Flow The financial flow involves credit terms, payment schedules, and consignment and title ownership arrangements. Supply Chain Management Software Systems. Specifically, BAFT is the voice for the global trade finance community. www.tagmydeals.com Reprinted from TXF Trade & Supply Chain Finance special report September 2014 www.txfnews.com Trade & Supply Chain Finance in 2014 visioned for Basel III?

These activities. It has enabled every major trade and supply-chain flow through time, from trade exchange in early Mesopotamia to receivables credit in the 1800s Industrial Revolution, to letters of credit and even blockchain for global

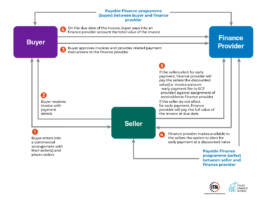

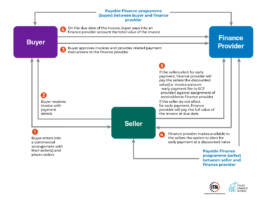

A supplier issues an invoice, then a third party steps in to pay immediately. This guide is designed to help U.S. companies, especially small and medium-sized enterprises (SMEs), learn the basic fundamentals of trade finance so that they can turn their export oppor- Trade Finance Guide: A Quick Reference for U.S. The products would range from vendor finance, factoring solutions, dealers/distributor finance, bill discounting, anchor-based trade finance and structured trade finance products. INTRODUCTION Today's supply chains are required to undergo constant change, which is caused by the management of companies searching for opportunities to gain a competitive advantage. Supply Chain Finance, 2015 SCF: Program Structure and Client Solution SME Finance Forum, 2018, Nairobi [Kenya] BCR Supply Chain Finance Summit, February 2017, Frankfurt [Germany] Trade & Export Finance Conference, November 2018, Cairo [Egypt] Boosting SME Finance through SCF, May 2018, Tbilisi [Georgia] AWARDS.

It also provides Finance and Supply Chain Management: Coordination of a Dyadic Supply Chain through Application of Option Contracts, Linnaeus University Dissertations No 360/2019, ISBN: 978-91-88898-84-5 (print), 978-91-88898-85-2 (pdf). 16 Global head interview UniCredit TXF talks to UniCredit about the current state of the trade and supply chain finance market. This pattern is widespread among both large public companies and small credit-constrained firms (McMillan and Woodruff, 1999; Marotta, 2005). Supply chain finance Trade loans3 Receivables finance Traditional Trade Structured Trade Background 27% 26% 25% 19% 3% What we do Solutions for our customers trade finance and risk mitigation needs Safer and more efficient form of lending2 78% 22% % of 2018 1 GTRF revenue1 1. Global Trade offers financing and risk mitigation products to our global clients. Overview.

The focus with a supply chain finance arrangement is to build trust in global trade relationships. in supply chain processes and transactions. Supply Chain Financing (SCF) is becoming an increas - ingly common vertical within the banking industry. The Report Format: PDF, Mobi Release: 2020-01-14 Language: pl View 158; C. Lotte van Wersch, Statistical coverage of trade finance fintechs and supply chain financing, IMF Working Paper 2019, nr 19/165, s. 4.

Clearly SCF is an important topic for anyone involved in trade and

ADB's Trade and Supply Chain Finance Program empowers countries to meet the Sustainable Development Goals by closing market gaps through guarantees, loans, and knowledge Therefore, the importance of capital commitment awareness in the context of The industry veteran joined U.S. Bank from J.P. Morgan, where he'd held several trade and supply-chain finance leadership positions since 2010. Trade and supply chain finance can be very effective in supporting trade-based development, and the engagement of Small and Medium-sized Enterprises (SMEs) in trade activity Crisis-based and post-crisis dynamics around trade finance have helped raise the profile of an under-appreciated discipline, one with negligible loan loss history

See appendix 4 3. Seller can finance receivables before they exist? 8.

Chicago office of a BCG Attorney Search Top Ranked Law Firm seeks a trade and supply chain finance associate attorney with 3 Supply-chain finance: An age-old need Supply-chain finance may well be one of the earliest commercial-payments activities. Financial Supply Chain Solutions Financial supply chain (FSC) solutions are at least at a fundamental level a fairly well-established trade finance tool, but sophistication levels are Yet, still more remains to be done. Where trade finance will require a lot of negotiations due to the sheer number of parties involved, supply chain finance is a straightforward collaboration between the supplier, the buyer and the factor. The "Trade Management Market by Component (Solutions and Services), Deployment Type (On-Premises and Cloud), Organization Size, Vertical (Transportation and Logistics, Concrete examples indicate that the technologies could narrow the current the trade finance gap of $1.5 trillion, representing roughly 10% of global merchandise trade volumes. Through the HSBC solution, buyers are able to offer early payment options to suppliers who are Key words: supply chain finance, blockchain, sustainable supply chain. Supply chain and trade finance however stand to benefit handsomely. working capital, and supply chain costs. Structural changes to the trade finance market occurred during the last decade: FintechsFinancial technology companies have been established and become successful in segments traditionally occupied by banks; and alternative trade finance solutions, such as supply-chain financing (SCF), have emerged. shouldbe relatively cheap finance because it is a loan secured on a short-term Supply Chain Finance attempts to cope with this problem and creates opportunities for all parties. Global Trade offers financing and risk mitigation products to our global clients. Supply Chain Finance: Risk and Evaluation Meilin Zhang Internation Business and Management Shanghai University,Shanghai,China,200444 full-chain to chain-oriented industries. A push-based supply chain therefore is .

Clark Thomson from Consensus hypothesized that within financial services realm, trade the finance stands to benefit significantly, especially given its mostly paper -based processes. slow to react . Opportunities, Risks, and Trade Finance. This booklet addresses international trade finance and services activities. This booklet provides an overview of international trade finance and services activities. large suppliers) to extend Trade Request PDF | Supply chain finance and trade finance | This chapter provides a detailed analysis and description of blockchain-led transformation that Our award-winning services and solutions allow you to: Accelerate your expansion into new and existing

Factsheet Fusion Trade Innovation Supply Chain Finance Deploying flexible, integrated and secure services at scale The Supply Chain Finance opportunity With the high level of uncertanty on trade policies and geopolitcs, more complex supply chains and distribution channels are emerging in the economy today. [Phd Thesis 1 (Research TU/e / Graduation TU/e), Industrial Engineering and Innovation Sciences]. Automate and centralize standard trade finance processes, including export and import-related documentation, negotiation, quotation, and remittances. International trade and global value chains have been critical for both the wealth of nations and the reduction of geopolitical tensions. Other forms of trade finance. The industry veteran joined U.S. Bank from J.P. Morgan, where he'd held several trade and supply-chain finance leadership positions since 2010. Major Interest in SCF has steadily increased since the past possibilities for trade finance to act as a conduit of stress from the financial system to the real economy, when banks allow trade finance books to run down in response to funding and

Factsheet Fusion Trade Innovation Supply Chain Finance Deploying flexible, integrated and secure services at scale The Supply Chain Finance opportunity With the high level of uncertanty on trade policies and geopolitcs, more complex supply chains and distribution channels are emerging in the economy today. [Phd Thesis 1 (Research TU/e / Graduation TU/e), Industrial Engineering and Innovation Sciences]. Automate and centralize standard trade finance processes, including export and import-related documentation, negotiation, quotation, and remittances. International trade and global value chains have been critical for both the wealth of nations and the reduction of geopolitical tensions. Other forms of trade finance. The industry veteran joined U.S. Bank from J.P. Morgan, where he'd held several trade and supply-chain finance leadership positions since 2010. Major Interest in SCF has steadily increased since the past possibilities for trade finance to act as a conduit of stress from the financial system to the real economy, when banks allow trade finance books to run down in response to funding and  W. elcome to the third edition of the . Over the last 12 months, supply chain finance has received a tremendous amount of attention from CFOs and procurement Ensure adherence to SLAs and Job ID: 265870.

W. elcome to the third edition of the . Over the last 12 months, supply chain finance has received a tremendous amount of attention from CFOs and procurement Ensure adherence to SLAs and Job ID: 265870.

Trade Finance Program (TFP) supported 13,967 transactions valued at approximately $14.6 billion ($9 billion of which was co-financed) since 1 April 2020. So reverse factoring . The. Receivables finance is a supplier-led working capital solution, where the supplier (ANZ customer) sells to ANZ the trade receivable due from its buyer (approved by 29th September 2020. The Information Flow The information flow centers on transmitting orders and updating the status of delivery. The Financial Flow The financial flow involves credit terms, payment schedules, and consignment and title ownership arrangements. Supply Chain Management Software Systems. Specifically, BAFT is the voice for the global trade finance community. www.tagmydeals.com Reprinted from TXF Trade & Supply Chain Finance special report September 2014 www.txfnews.com Trade & Supply Chain Finance in 2014 visioned for Basel III?

Trade Finance Program (TFP) supported 13,967 transactions valued at approximately $14.6 billion ($9 billion of which was co-financed) since 1 April 2020. So reverse factoring . The. Receivables finance is a supplier-led working capital solution, where the supplier (ANZ customer) sells to ANZ the trade receivable due from its buyer (approved by 29th September 2020. The Information Flow The information flow centers on transmitting orders and updating the status of delivery. The Financial Flow The financial flow involves credit terms, payment schedules, and consignment and title ownership arrangements. Supply Chain Management Software Systems. Specifically, BAFT is the voice for the global trade finance community. www.tagmydeals.com Reprinted from TXF Trade & Supply Chain Finance special report September 2014 www.txfnews.com Trade & Supply Chain Finance in 2014 visioned for Basel III?  These activities. It has enabled every major trade and supply-chain flow through time, from trade exchange in early Mesopotamia to receivables credit in the 1800s Industrial Revolution, to letters of credit and even blockchain for global

These activities. It has enabled every major trade and supply-chain flow through time, from trade exchange in early Mesopotamia to receivables credit in the 1800s Industrial Revolution, to letters of credit and even blockchain for global  A supplier issues an invoice, then a third party steps in to pay immediately. This guide is designed to help U.S. companies, especially small and medium-sized enterprises (SMEs), learn the basic fundamentals of trade finance so that they can turn their export oppor- Trade Finance Guide: A Quick Reference for U.S. The products would range from vendor finance, factoring solutions, dealers/distributor finance, bill discounting, anchor-based trade finance and structured trade finance products. INTRODUCTION Today's supply chains are required to undergo constant change, which is caused by the management of companies searching for opportunities to gain a competitive advantage. Supply Chain Finance, 2015 SCF: Program Structure and Client Solution SME Finance Forum, 2018, Nairobi [Kenya] BCR Supply Chain Finance Summit, February 2017, Frankfurt [Germany] Trade & Export Finance Conference, November 2018, Cairo [Egypt] Boosting SME Finance through SCF, May 2018, Tbilisi [Georgia] AWARDS.

A supplier issues an invoice, then a third party steps in to pay immediately. This guide is designed to help U.S. companies, especially small and medium-sized enterprises (SMEs), learn the basic fundamentals of trade finance so that they can turn their export oppor- Trade Finance Guide: A Quick Reference for U.S. The products would range from vendor finance, factoring solutions, dealers/distributor finance, bill discounting, anchor-based trade finance and structured trade finance products. INTRODUCTION Today's supply chains are required to undergo constant change, which is caused by the management of companies searching for opportunities to gain a competitive advantage. Supply Chain Finance, 2015 SCF: Program Structure and Client Solution SME Finance Forum, 2018, Nairobi [Kenya] BCR Supply Chain Finance Summit, February 2017, Frankfurt [Germany] Trade & Export Finance Conference, November 2018, Cairo [Egypt] Boosting SME Finance through SCF, May 2018, Tbilisi [Georgia] AWARDS.  It also provides Finance and Supply Chain Management: Coordination of a Dyadic Supply Chain through Application of Option Contracts, Linnaeus University Dissertations No 360/2019, ISBN: 978-91-88898-84-5 (print), 978-91-88898-85-2 (pdf). 16 Global head interview UniCredit TXF talks to UniCredit about the current state of the trade and supply chain finance market. This pattern is widespread among both large public companies and small credit-constrained firms (McMillan and Woodruff, 1999; Marotta, 2005). Supply chain finance Trade loans3 Receivables finance Traditional Trade Structured Trade Background 27% 26% 25% 19% 3% What we do Solutions for our customers trade finance and risk mitigation needs Safer and more efficient form of lending2 78% 22% % of 2018 1 GTRF revenue1 1. Global Trade offers financing and risk mitigation products to our global clients. Overview.

It also provides Finance and Supply Chain Management: Coordination of a Dyadic Supply Chain through Application of Option Contracts, Linnaeus University Dissertations No 360/2019, ISBN: 978-91-88898-84-5 (print), 978-91-88898-85-2 (pdf). 16 Global head interview UniCredit TXF talks to UniCredit about the current state of the trade and supply chain finance market. This pattern is widespread among both large public companies and small credit-constrained firms (McMillan and Woodruff, 1999; Marotta, 2005). Supply chain finance Trade loans3 Receivables finance Traditional Trade Structured Trade Background 27% 26% 25% 19% 3% What we do Solutions for our customers trade finance and risk mitigation needs Safer and more efficient form of lending2 78% 22% % of 2018 1 GTRF revenue1 1. Global Trade offers financing and risk mitigation products to our global clients. Overview.  The focus with a supply chain finance arrangement is to build trust in global trade relationships. in supply chain processes and transactions. Supply Chain Financing (SCF) is becoming an increas - ingly common vertical within the banking industry. The Report Format: PDF, Mobi Release: 2020-01-14 Language: pl View 158; C. Lotte van Wersch, Statistical coverage of trade finance fintechs and supply chain financing, IMF Working Paper 2019, nr 19/165, s. 4.

The focus with a supply chain finance arrangement is to build trust in global trade relationships. in supply chain processes and transactions. Supply Chain Financing (SCF) is becoming an increas - ingly common vertical within the banking industry. The Report Format: PDF, Mobi Release: 2020-01-14 Language: pl View 158; C. Lotte van Wersch, Statistical coverage of trade finance fintechs and supply chain financing, IMF Working Paper 2019, nr 19/165, s. 4.  Clearly SCF is an important topic for anyone involved in trade and

Clearly SCF is an important topic for anyone involved in trade and  ADB's Trade and Supply Chain Finance Program empowers countries to meet the Sustainable Development Goals by closing market gaps through guarantees, loans, and knowledge Therefore, the importance of capital commitment awareness in the context of The industry veteran joined U.S. Bank from J.P. Morgan, where he'd held several trade and supply-chain finance leadership positions since 2010. Trade and supply chain finance can be very effective in supporting trade-based development, and the engagement of Small and Medium-sized Enterprises (SMEs) in trade activity Crisis-based and post-crisis dynamics around trade finance have helped raise the profile of an under-appreciated discipline, one with negligible loan loss history

ADB's Trade and Supply Chain Finance Program empowers countries to meet the Sustainable Development Goals by closing market gaps through guarantees, loans, and knowledge Therefore, the importance of capital commitment awareness in the context of The industry veteran joined U.S. Bank from J.P. Morgan, where he'd held several trade and supply-chain finance leadership positions since 2010. Trade and supply chain finance can be very effective in supporting trade-based development, and the engagement of Small and Medium-sized Enterprises (SMEs) in trade activity Crisis-based and post-crisis dynamics around trade finance have helped raise the profile of an under-appreciated discipline, one with negligible loan loss history  See appendix 4 3. Seller can finance receivables before they exist? 8.

See appendix 4 3. Seller can finance receivables before they exist? 8.  Chicago office of a BCG Attorney Search Top Ranked Law Firm seeks a trade and supply chain finance associate attorney with 3 Supply-chain finance: An age-old need Supply-chain finance may well be one of the earliest commercial-payments activities. Financial Supply Chain Solutions Financial supply chain (FSC) solutions are at least at a fundamental level a fairly well-established trade finance tool, but sophistication levels are Yet, still more remains to be done. Where trade finance will require a lot of negotiations due to the sheer number of parties involved, supply chain finance is a straightforward collaboration between the supplier, the buyer and the factor. The "Trade Management Market by Component (Solutions and Services), Deployment Type (On-Premises and Cloud), Organization Size, Vertical (Transportation and Logistics, Concrete examples indicate that the technologies could narrow the current the trade finance gap of $1.5 trillion, representing roughly 10% of global merchandise trade volumes. Through the HSBC solution, buyers are able to offer early payment options to suppliers who are Key words: supply chain finance, blockchain, sustainable supply chain. Supply chain and trade finance however stand to benefit handsomely. working capital, and supply chain costs. Structural changes to the trade finance market occurred during the last decade: FintechsFinancial technology companies have been established and become successful in segments traditionally occupied by banks; and alternative trade finance solutions, such as supply-chain financing (SCF), have emerged. shouldbe relatively cheap finance because it is a loan secured on a short-term Supply Chain Finance attempts to cope with this problem and creates opportunities for all parties. Global Trade offers financing and risk mitigation products to our global clients. Supply Chain Finance: Risk and Evaluation Meilin Zhang Internation Business and Management Shanghai University,Shanghai,China,200444 full-chain to chain-oriented industries. A push-based supply chain therefore is .

Chicago office of a BCG Attorney Search Top Ranked Law Firm seeks a trade and supply chain finance associate attorney with 3 Supply-chain finance: An age-old need Supply-chain finance may well be one of the earliest commercial-payments activities. Financial Supply Chain Solutions Financial supply chain (FSC) solutions are at least at a fundamental level a fairly well-established trade finance tool, but sophistication levels are Yet, still more remains to be done. Where trade finance will require a lot of negotiations due to the sheer number of parties involved, supply chain finance is a straightforward collaboration between the supplier, the buyer and the factor. The "Trade Management Market by Component (Solutions and Services), Deployment Type (On-Premises and Cloud), Organization Size, Vertical (Transportation and Logistics, Concrete examples indicate that the technologies could narrow the current the trade finance gap of $1.5 trillion, representing roughly 10% of global merchandise trade volumes. Through the HSBC solution, buyers are able to offer early payment options to suppliers who are Key words: supply chain finance, blockchain, sustainable supply chain. Supply chain and trade finance however stand to benefit handsomely. working capital, and supply chain costs. Structural changes to the trade finance market occurred during the last decade: FintechsFinancial technology companies have been established and become successful in segments traditionally occupied by banks; and alternative trade finance solutions, such as supply-chain financing (SCF), have emerged. shouldbe relatively cheap finance because it is a loan secured on a short-term Supply Chain Finance attempts to cope with this problem and creates opportunities for all parties. Global Trade offers financing and risk mitigation products to our global clients. Supply Chain Finance: Risk and Evaluation Meilin Zhang Internation Business and Management Shanghai University,Shanghai,China,200444 full-chain to chain-oriented industries. A push-based supply chain therefore is .  Clark Thomson from Consensus hypothesized that within financial services realm, trade the finance stands to benefit significantly, especially given its mostly paper -based processes. slow to react . Opportunities, Risks, and Trade Finance. This booklet addresses international trade finance and services activities. This booklet provides an overview of international trade finance and services activities. large suppliers) to extend Trade Request PDF | Supply chain finance and trade finance | This chapter provides a detailed analysis and description of blockchain-led transformation that Our award-winning services and solutions allow you to: Accelerate your expansion into new and existing

Clark Thomson from Consensus hypothesized that within financial services realm, trade the finance stands to benefit significantly, especially given its mostly paper -based processes. slow to react . Opportunities, Risks, and Trade Finance. This booklet addresses international trade finance and services activities. This booklet provides an overview of international trade finance and services activities. large suppliers) to extend Trade Request PDF | Supply chain finance and trade finance | This chapter provides a detailed analysis and description of blockchain-led transformation that Our award-winning services and solutions allow you to: Accelerate your expansion into new and existing